El Rey Theatre is located on Wilshire Blvd in between La Brea Ave and Fairfax Ave in the Miracle Mile area. Our exact cross streets are Burnside and Dunsmuir.

Self Parking

5455 Wilshire Blvd enter on S. Cochran Ave (lot opens at 6:30p). Cash only. Lot closes 30 minutes after show ends.

5670 Wilshire Blvd enter on S Hauser Ave

5550 Wilshire Blvd enter on S Burnside

Public Transportation

Metro Line 20 stops at Wilshire/Dunsmuir.

DASH Fairfax stops at Wilshire/Burnside (Stop #2303).

The Empire Polo Club is a 78-acre polo club in Indio, California in the Coachella Valley of Riverside County, approximately 22 miles southeast of Palm Springs.

Fox Theater Pomona is located in Pomona, CA on the corner of Garey Avenue and 3rd Street.

Parking

View Area Parking Map

Public Transportation

The Metrolink Riverside Line stops at the Downtown Pomona Station. The station is located two blocks from the Fox Theater Pomona.

Transit Routes 286, 291, and 480 stop directly in front of the Fox Theater Pomona on Garey Avenue and Third Street

The Fonda Theatre is located in Hollywood, CA on historic Hollywood Blvd. Just off of the 101 FWY between and Gower St. and El Centro St. From the 101 FWY exit Gower St. going South. The venue is located just to the West of Gower on Hollywood Blvd.

Parking

We do not operate any parking lots around us but can recommend the following:

Hollywood & Gower Lot: the closest parking lot is located next door to us at the corner of Hollywood & Gower (enter on Gower), prices vary on a show by show basis and the lot is not operated by us.

Street Parking: there are several additional lots in the area as well as limited metered parking on the surrounding streets. Please pay attention to the street parking signs!

Public Transportation

By Train: the closest Metro stop is 'Hollywood & Vine' on the Metro B Line (Red).. Visit metro.net for more details.

By Bus: Metro Line 180 (Stop ID: 12445) & Line 217 (Stop ID: 5069)

Frost Amphitheater is located at 351 Lasuen Street, at the intersection of Lasuen Street and Roth Way on the Stanford University campus.

Parking

Due to capacity, we recommend purchasing an Event Parking Pass with your ticket. There is a very limited amount of free parking available around the venue that is expected to fill up quickly on a first come, first served basis.

Event parking is available in the Stanford Galvez Lot and passes can be purchased in advance during your ticket purchase, or when you arrive (subject to availability). We accept credit/debit card only.

Public Transportation

Stanford University is accessible by several transit agencies, making it possible to get to campus from just about anywhere. The Palo Alto Caltrain Station is a 20 minute walk from Frost. All performances will end in enough time for patrons to catch the Caltrain home northbound or southbound, with time to make connections to the BART station in Millbrae.

Located in downtown Los Angeles, Peacock Theater is easily accessible from several major freeways and from a variety of public transportation options.

Facing the scenic downtown Long Beach skyline, the Queen Mary Events Park sits on four pristine oceanfront acres.

Help green your footprint by purchasing a reusable SB Bowl Pint and receive $1 off every refill at all future shows for the life of the pint.

PARKING

ARRIVE EARLY! It can take over 30 minutes to get from your car to your seat.

Parking is $20 at Santa Barbara High School (enter on Anapamu St.) and The Armory (enter on Nopal St.).

Shh! Respect Our Neighbors The Bowl is located in a residential neighborhood; please be respectful. Use the High School parking lot, park in legal areas, keep noise to a minimum and don't litter.

- No tailgating - no alcohol, no picnicking.

- No amplified music.

- Parking lot closes 30 minutes after concert ends.

PARKING

There are a number of parking lots near the Shrine. Please visit shrineauditorium.com for maps and details.

Public Transportation

The Shrine Auditorium & Expo Hall is easily accessible via the Metro Expo Line (5 minute walk from Jefferson/USC station) and multiple bus lines.

The Shrine Auditorium & Expo Hall is easily accessible via the Metro Expo Line (5 minute walk from Jefferson/USC station) and multiple bus lines.

The Shrine Auditorium & Expo Hall is easily accessible via the Metro Expo Line (5 minute walk from Jefferson/USC station) and multiple bus lines.

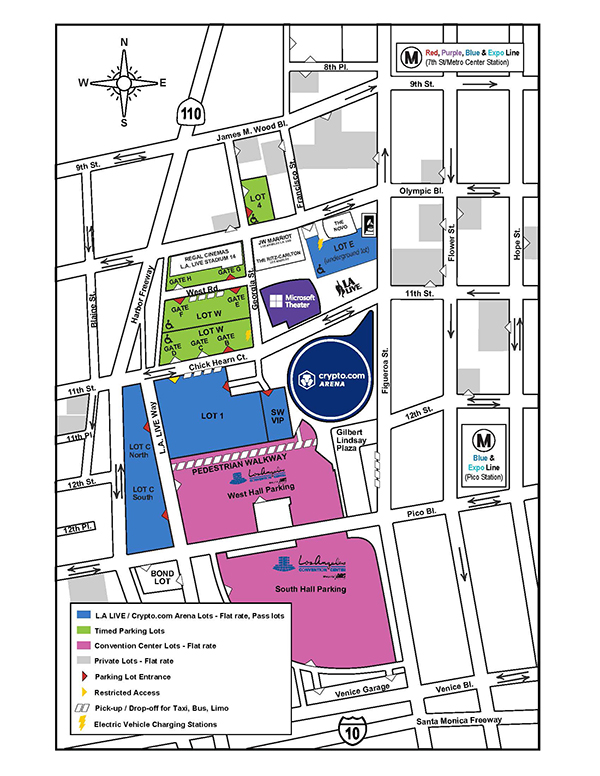

PARKING

Parking lots controlled by our venues open 2 1/2 hours prior to events and remain open one hour after the event's conclusion. Parking rates vary and are subject to change.

The Novo does not endorse or control parking rates or policies at non-company owned or operated parking locations.

View Area Parking Map

PUBLIC TRANSPORTATION

There are many alternative forms of transportation to The Novo events, including Metro Rail and Metro Buses, which frequently stop near The Novo. If you're coming to The Novo by train, Metro Rail Pico Station is only a block away from The Novo. To find the route that's best for you, use the Trip Planner on www.metro.net.

LIMITED VALET PARKING

Enter between The Roxy & The Rainbow Bar and Grill

PARKING IS ALSO AVAILABLE

9000 Sunset Blvd ( directly across the street ) and other lots within a few blocks of the venue

8981 Sunset Blvd

9022 Sunset Blvd ( next to Shamrock Tattoo )

The Regency Ballroom is on the Northeast corner of Van Ness & Sutter.

PARKING

There are plenty of public and private parking lots in the vicinity of The Regency Ballroom. There is also limited street parking.

Public Transportation

Because of its central location, the Regency Building is easily accessible by public transportation. Muni bus lines 1, 2, 3, 4, 19, 38, 42, 47, and 49 all stop within a few blocks of the facility.

The Warfield is easily accessible by using public transit. You can take BART or MUNI to the Powell Street station. Exit onto Market Street, and walk 1 1/2 blocks south to The Warfield. The stations are near 5th Street and Market, and the Warfield is by 6th Street.

Humphreys Concerts by the Bay is located between Humphreys Restaurant and Humphreys Half Moon Inn.

Parking

Park in lot between Humphreys Half Moon Inn and Humphreys Restaurant. Parking is available at Humphreys for $25.

Free public parking lots are located nearby on Shelter Island.

Self Parking

Guests may use the complimentary self-parking in the North Parking Garage off of Pechanga Parkway, or in the East Parking Garage off of Pechanga Resort Drive.

EV chargers are available complimentary to Pechanga guests in both parking garages.

Valet Parking

Pechanga valet is available upon arrival, or at any point during your stay at Pechanga Resort Casino. Simply pull your vehicle up to the Hotel Valet portacache and one of our friendly attendants will assist you.

To pick up your vehicle, visit the Self Service Kiosk located right inside the doors of the Hotel Valet entrance.

Parking

- Parking opens 2 1/2 hours before show time.

- Only motor vehicles are permitted on The Mountain Winery driveway. For safety reasons, pedestrians and bicyclists cannot be permitted beyond The Mountain Winery main entrance.

- General and ADA parking is $25 on-site, carpool of 3 or more is $20. Limited ADA parking available on site. Premium Parking on the night of the event is $45 if available.

Rideshare

On concert nights, if you arrive via rideshare program and are expecting a pick up after the show, please be aware that traffic coming up the hill is stopped at bottom entrance gate 30 minutes prior to the show ending. All rideshare vehicles are held at main gate until parking lot traffic is cleared (approximately a 45 minute wait). Please join us at Redwood Deck Rideshare Lounge located in the main plaza while you wait where our attentive staff will take care of you until rideshare vehicles proceed up hill.

SET YOUR REGION TO SEE UPCOMING EVENTS NEAR YOU